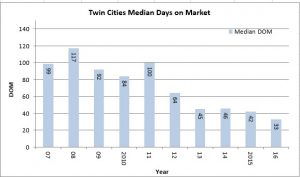

As we have previously stated in other recent posts, the supply of homes for-sale is at all time-lows; here in the Twin Cities and across many markets in the U.S. This lack of inventory has driven up housing costs as buyers have fewer options and homes are selling with multiple offers. This past week alone; the Mullins Group was planning on bringing buyers through new listings that sold within a day as offers were submitted instantly on listings and sold within hours of going active. As a result, buyers have to be ready to move quickly and ready to offer full asking price or even more than the list price to secure the property.

The winning bidder of a Grand Rapids, Michigan, house has been offered almost $20,000 to hand his purchase contract to another buyer. An agent in Nashville, Tennessee, got a property for his client by cold-calling local homeowners. Near Columbus, Ohio, it took a teacher five tries to secure a deal.

It’s the 2017 U.S. spring home-selling season, and listings are scarcer than they’ve ever been. Bidding wars common in perennially hot markets like the San Francisco Bay area, Denver and Boston are now also prevalent in the once slow-and-steady heartland, sending prices higher and sparking desperation among buyers across the country.

“Homebuyers are going to find this spring that, in a lot of markets, the inventory of homes priced and sized at price levels they were hoping for will be very limited,” said Thomas Lawler, a former Fannie Mae economist who’s now a housing consultant in Leesburg, Virginia. “Unlikely places are getting significantly tighter.”

Buyers are clamoring as an improved job market and growing confidence in the economy collide with rising mortgage rates — yet there’s little new inventory for them to purchase. Housing starts remain well below levels before the last recession, and builders have focused on higher-end properties out of reach for many people. Homeowners have become even more reluctant to sell because, after all, where are they going to move?

The three months through January had the fewest homes on the market on record, according to an analysis by Trulia. Prices jumped 6.9 percent in January from a year earlier, the biggest increase for any month since May 2014, data from CoreLogic Inc. show. And homes sold faster in the first two months of 2017 — spending an average 58 days on the market — than at the start of any year since at least 2010, according to brokerage Redfin.

Homes are moving fastest in Denver, Seattle and Oakland, California — areas where heated competition have become status quo in recent years because of soaring job growth, particularly in the technology industry. But fourth on Redfin’s list is Grand Rapids, Michigan’s second-largest city, in a reflection of strengthening employment across even the slower-growing center of the country. Buyers are also struggling in cities such as Boise, Idaho; Madison, Wisconsin; and Omaha, Nebraska.

Cash offer

Grand Rapids — a diverse economy underpinned by health care, technology and manufacturing companies, with a 3 percent unemployment rate — has seen a 27 percent drop in homes for sale in the past year. One listing recently attracted 40 bids.

Competition is so extreme that real estate agent Tanya Craig, working with an out-of-town couple six months into a search for a home near their grandchildren, had to get creative. She called an agent representing a buyer who just signed a contract for a $350,000 house and offered about $18,000 in cash if her clients could purchase it instead. Craig, an associate broker with the Katie K team at Keller Williams, is waiting to hear back.

“People need to get their houses on the market, but they’re gun-shy,” Craig said. “Unless they know where they want to go, everyone is hesitant.”

While sellers are losing their nerve, buyer confidence has climbed since the November election, hitting a new high in February, according to Fannie Mae, which began its sentiment index in 2011. The unemployment rate is at 4.7 percent and business confidence has soared amid President Donald Trump’s vows to lower taxes, increase infrastructure spending and trim regulations. Rents are also at a record, making ownership more attractive.

Rising costs

Would-be purchasers have a reason to rush as rising borrowing costs — and prices — close off opportunities. The 30-year fixed mortgage rate has jumped by more than half a percentage point since the election. The Federal Reserve this week increased its benchmark interest rate by a quarter point and signaled it will do so two more times this year, boosting borrowing costs from low levels that have been in place for almost a decade.

The average 30-year rate probably will climb to 4.7 percent by the end of 2017, from 4.3 percent this week, and could reach 5.5 percent next year, said Lawrence Yun, chief economist of the National Association of Realtors.

Higher mortgage costs could eventually shrink the pool of buyers able to qualify, but it may also discourage homeowners from selling because they might have to take out a more expensive loan to purchase something else.

“In today’s market, many buyers think the trough in rates is over,” said Sam Khater, deputy chief economist at CoreLogic. “If you don’t get in now, it’s just going to be worse later. Rates will be higher, prices will be higher and maybe inventory selection will be lower.”

Older people who may typically move are choosing to stay where they are, Chris Herbert, managing director for Harvard University’s Joint Center for Housing Studies, said in an interview Friday.

“One factor is that you have the baby boom generation on its way to being 65-plus,” Herbert said. “They’re moving less so you have fewer homes on the market. That could be part of the glue keeping the market stuck.”

Price gains

There are pockets of the country, such as Miami and Manhattan, where inventory has climbed amid new construction and less interest from foreigners, and some regions have yet to experience the job gains that fuel housing demand. Yet other cities that haven’t had strong price gains in recent years are now seeing a big jump.

In Philadelphia, prices for single-family houses jumped 11 percent in the fourth quarter from a year earlier, compared with a gain of less than 5 percent at the end of 2015, according to Kevin Gillen, a senior research fellow at Drexel University.

Buyers are making full-price offers before properties have even been listed, said Mike McCann, associate broker with Berkshire Hathaway HomeServices Fox & Roach.

“We might end up with fewer transactions in 2017 because we don’t have inventory,” McCann said. “Thirty-five percent of my properties are selling within the first week or two of hitting the market.”

Calling owners

Rich Ramsey, an agent with the Helton Group at Keller Williams in Nashville, has been knocking on doors and working the phones. When he heard from a family frustrated after losing out on two homes they liked in a townhouse development in the city’s Midtown neighborhood, Ramsey started calling owners in the area.

“I found someone who had considered selling,” Ramsey said. “I asked if they had a price in mind and we started negotiating.”

The family purchased the three-bedroom property in January for a price in the low $400,000s, Ramsey said.

For some buyers, patience and persistence can pay off. Jessica Streit, a 42-year-old teacher and mother of two, has been searching for months for a home in Sunbury, Ohio, north of Columbus. She lost three bidding wars and even went into contract on a home, only to back out after an inspection revealed some expensive problems. Last week, her fortunes changed — she signed a $136,000 deal for a two-bedroom condominium with a finished basement.

“We were absolutely shocked to get this one,” she said. “We had an appointment to see a rental house Saturday because we thought that would be our next direction.”