By Matt Mullins on February 12, 2015

About 25% of home purchases in Minnesota have been cash sales (i.e. no mortgage). This is lower than the national average of 36% and is down from a few years back in the Great Recession. During the downturn and ensuing Great Recession; real estate investors purchased homes at discounted rates and accounted for a significant number of transactions; many of which were cash purchase agreements. The percentage of cash sales varies considerably based on housing type; for example buyers of new homes have a much lower rate than resales or distressed real estate. Going forward, the Mullins Group projects this percentage to continue to decline as the housing market rebounds and stabilizes in 2015.

Cash Transactions Made Up 36 Percent of All Home Sales in November 2014

Michigan Had the Highest Cash Sales Share of Any State in November

Molly Boesel | Housing Trends

Cash sales made up 36.1 percent of total home sales in November 2014, down from 38.8 percent in November 2013. The year-over-year share has fallen each month since January 2013, making November the 23rd consecutive month of declines. Month over month, the cash sales share ticked up by half of a percentage point, as is typical for the fall and winter months. Due to seasonality in the housing market, cash sales share comparisons should be made on a year-over-year basis. The peak occurred in January 2011 when cash transactions made up 46.4 percent of total home sales. Prior to the housing crisis, the cash sales share of total home sales averaged approximately 25 percent. Continue reading “Nearly 25% of home sales in Minnesota are cash transactions”

Posted in Buyers, Market Stats, Misc., Mortgage/Finance, Twin Cities Real Estate

By Matt Mullins on February 5, 2015

The number of homes that have been flipped in the Twin Cities is down considerably as the market continues to show positive momentum. Investors were particularly attracted to flipping homes during the Great Recession when lender-mediated properties could be purchased for cents on the dollar; resulting in instant equity to the new buyer. together with cosmetic improvements, home flippers in the Twin Cities make healthy returns on their investments. However, there are fewer foreclosures and short sales today; resulting in fewer opportunities for investors to purchase homes at a discounted value. As a result, the number of home purchases today are mostly dominated by traditional buyers. Today’s article from Trulia is an interesting article on the percent of transactions that are flipped properties and the year-over-year price gains in the markets with the most activity.

Flipping is the practice of buying a house and reselling in a short period. Both professional and casual investors flip houses. And like other asset trading, successful flipping involves buying at a discount, selling at a premium, or both—all of which is sensitive to changes in housing prices. We at Trulia Trends set out to explore at what point in the housing market price cycle flipping activity pick ups. Continue reading “Home flipping slowdown in the Twin Cities”

Posted in Buyers, Investment Real Estate, Twin Cities Real Estate

By Matt Mullins on February 4, 2015

2015 New construction in Blaine

Every year I’m asked what’s in store for the next year? Although I can’t predict the future (or I would be playing the lottery!) I predict 2015 will continue last year’s positive momentum. Most economists agree that the Federal Reserve will raise interest rates in 2015; when though it is unknown. We should continue to find rock-bottom interest rates through the first half of 2015; however interest rates are bound to rise thereby decreasing affordability (up to 10%!). Home prices are projected to also increase modestly and home sales are also going to surpass 2014 volume.

2015 New construction

Foreclosure activity continues to wane as traditional sales are once again dominating most transactions; this is great news for former under-water homeowners who have recovered lost equity. Distressed sales are no longer weighing on the overall market which will provide increased appreciation for most housing markets. The improvements in the economy with low gas prices will also bring the exurban and suburban markets back as buyers will seek out outer-laying locations for new construction that is more affordable than housing in the inner-core.

All things considered; expect a healthier real estate market in 2015 and if your are a buyer we recommend beginning your house hunt sooner than later before the uptick in interest rates.

Posted in Buyers, First Time Home Buyers, Market Stats, Sellers, Twin Cities Real Estate

By Matt Mullins on January 29, 2015

Although we as hardy Minnesotan’s have been mostly sparred by Mother Nature this winter; the notion of a heated driveway could be the next fad in new construction and home renovations. Historically only high-end homes offered heated driveways, however the cost to install and operate a heated driveway has come down and more and more homeowners in cold climates are thinking about this upgrade and a viable option. Although the cost to install a single-car driveway can be $2,500+, the notion of not shoveling on a cold winter day may be worth it to many homeowners.

Heated Driveways: A Shovel-Free Solution in Snowstorms

Posted in Home Improvement, New Construction

By Matt Mullins on October 15, 2014

The Economists at Trulia have done an excellent job providing an overview of key metrics we measure the housing market as we’ve come out of the Great Recession. The graphic below summarizes key housing market indicators related to a normal housing cycle. Over the past year numerous strides have occurred in the local Twin Cities real estate market..however there are still improvements needed to restore the market to the pre-recessionary housing stats. Although the Twin Cities Metro area’s unemployment rate has dropped substantially and new jobs are being created..most of the jobs have lower wages that were not to the same standard as last decade. Because of stagnant wage growth, almost all new construction housing is targeted to the move-up buyer as many first-time homebuyers cannot afford to purchase a new home in today’s economy.

Outside of the 7-county Metro core buyers can find new construction targeting first-time buyers. Both Wright County and Isanti County offer numerous homes priced from $140,000 that target entry-level buyers. Most of these homes are split-levels with about 1,000 finished square feet and an unfinished basement. The Mullins Group has invertiewed several builders; and the builders all say the only way they can offer new construction at a lower price point is through purchasing bank-owned lots. Since there are few quality lot in the Metro Area that can be purchased for cents on the dollar; new construction has once again moved out of the Metro Area.

Housing Barometer: Recovery Continues, But Virtuous Cycle Not So Saintly

Three out of five Housing Barometer measures are getting close to normal. But the two measures that hitch housing to the broader economy are still struggling, so the job market and housing market aren’t helping each other as they should.

How We Track This Uneven Recovery

Since February 2012, Trulia’s Housing Barometer has charted how quickly the housing market is returning to “normal” based on multiple indicators. Because the recovery is uneven, with some housing activities improving faster than others, our Barometer highlights five measures:

- Existing home sales, excluding distressed sales (National Association of Realtors, NAR)

- Home-price levels relative to fundamentals (Trulia Bubble Watch)

- Delinquency + foreclosure rate (Black Knight, formerly LPS)

- New construction starts (Census)

- The employment rate for 25-34 year-olds, a key age group for household formation and first-time homeownership (Bureau of Labor Statistics, BLS)

Home prices from our Bubble Watch is a quarterly report. The other four measures are reported monthly. To reduce volatility, we use three-month moving averages for these measures. For each indicator, we compare the latest available data to (1) its worst reading during the housing bust and (2) its pre-bubble “normal” level. Continue reading “Twin Cities Housing Barometer in the post recession economy”

Posted in First Time Home Buyers, Lender-mediated properties, Twin Cities Real Estate

By Matt Mullins on August 28, 2014

New construction homes have historically always commanded a premium price over the existing home market. However, since the housing downturn and Great Recession; the gap between the two product types has widened. In the Twin Cities Metro Area (as of July 2014) the median listing price for a new construction home was $359,900 ($147 per square foot PSF), compared to $193,000 among existing homes ($108 PSF). New construction today is nearly twice as high as existing homes; in-part because the majority of new construction today caters to move-up or executive-level buyers while foreclosures and short sales have pushed down the overall median sales pricing. Although builders are once again pursuing some spec housing; the majority of builders will not take the risk. As the inventory of lender-mediated properties continues to wane; the gap between new construction and existing homes should narrow.

Continue reading “Home Price Gap between Existing Homes and New Homes…”

Continue reading “Home Price Gap between Existing Homes and New Homes…”

Posted in Buyers, First Time Home Buyers, Market Stats, New Construction, Twin Cities Real Estate

By Matt Mullins on July 21, 2014

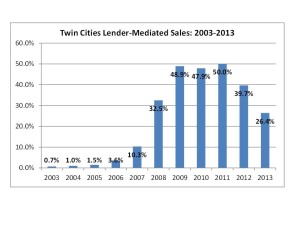

Good news for home sellers and existing home owners; the foreclosure crisis in the Twin Cities Metro Area continues to dwindle. Foreclosures accounted for only 12% of the resales in June 2014; this compares to 26% of all transactions in 2013 that were distressed sales. In fact, between 2009 and 2011 about one-half of all transactions in the Twin Cities area were considered distressed or lender-mediated sales.

Because of falling foreclosures, the overall median sales price continues to increase and was up to $192,000 and the end of 2013; an increase of +14% over 2012. Although the downfall is considered good news for the overall economy and housing market, it does increase affordability for first time homebuyers as housing costs are escalating. The Mullins Group expects lender-mediated transactions to continue to wane through 2013.

Continue reading “Twin Cities foreclosures continue to wane”

Posted in Buyers, Lender-mediated properties, Sellers

By Matt Mullins on May 23, 2014

It’s Memorial Day weekend; the first weekend of summer where Minnesotan’s are known for “going to the lake” for the next 12 precious weekends. With the never-ending winter of 2014, summer has finally arrived and people are once again ready to be out doors and enjoying Minnesota summers. The second home market, often called the vacation market, is rebounding nicely throughout Minnesota after bottoming out during the Great Recession. The 2nd home market is closely knit to the overall economy; as discretionary spending on 2nd homes wanes in recessionary times. It is estimated vacation sales are up +30% this past year in Minnesota and many of these buyers are paying cash. Home values are also escalating and the luxury market is coming back strong in the Brainerd lakes area and areas around Leech Lake.

If you and your family are considering a lake cabin, 2nd home, or investment property The Mullins Group recommends pursuing these properties now as pricing is still lower than the peak but on the rise again. Happy Memorial Day weekend!

Minnesota vacation home market is heating up

- Article by: JIM BUCHTA

- Star Tribune

- May 18, 2014 – 10:50 AM

Faith Blackwell has longed for a cozy lakefront home to spend holiday weekends with family. But it was only last summer that she found one to fit her family’s budget.

“It felt like prices reached the bottom,” said Blackwell, who along with her husband purchased a cottage a couple hours from their home in Oak Grove, in Anoka County. “There was no point in waiting.”

Minnesota’s vacation home market has turned a critical corner, with sales on the rise in many parts of the state. Such transactions increased nearly 30 percent nationwide last year to the highest level since 2006. Even listings that have been sitting on the market for years are starting to be sold off.

Continue reading “Minnesota Lake Home Market picking up in time for summer..”

Posted in First Time Home Buyers, Investment Real Estate, Vacation Homes

By Matt Mullins on May 13, 2014

The Twin Cities real estate market continues to favor sellers as the number of homes for sale (i.e supply) continues to be tight for buyers. Although supply has increased somewhat in the spring; there are not enough homes listed for sale in the Twin Cities Metro Area to meet buyer demand. As of April 2014, there are 3.4 months of inventory listed for sale in the Metro Area; about one-half of what is needed for a healthy market. Typically, a balanced market has about five to six months of supply. As a result, pricing is being driven up in desirable neighborhoods, especially for those homes that are move-in ready or turn-key. The Mullins Group estimates inventory will continue to increase as we enter the peak selling season; however we are concerned that inventory will not be high enough to meet buyer demand.

Twin Cities home listings rose in April, but remain in short supply

Article by: Jim Buchta

- Star Tribune

- May 12, 2014 – 9:36 PM

House listings in the Twin Cities metro rose 1.5 percent last month from their year-ago level, the biggest such increase in more than three years and a welcome sign for buyers frustrated by a lack of choices.

“What is happening now is hopefully a slow and steady rise to ‘normal’ levels,” said Emily Green, president of the Minneapolis Area Association of Realtors (MAAR).

April is typically the height of the spring buying season, but with new listings in short supply, closings have failed to keep pace with last year.

Last month, there were 3,806 closings, 11.9 percent fewer than in April 2013, according to a monthly sales report from MAAR. Continue reading “Twin Cities listings in short supply”

Posted in Buyers, First Time Home Buyers, Sellers

By Matt Mullins on May 13, 2014

A recent report by the National Association of Realtors for the first quarter of 2014 shows one-third of all real estate sales in Minnesota are for cash. Nationally, about 43% of all sales in the U.S. were cash transactions. During the Great Recession, the percentage of cash buyers increased significantly from mostly investors who purchased foreclosed homes at a discount. However, as the real estate market has improved over the past few years the percentage of investor sales has declined significantly. Today’s cash buyers include traditional buyers (i.e. a person who buys and lives in a house) versus the real estate investor. Although banks have loosened some credit approvals for buyers; financing continues to be challenging for those buyers with less than perfect credit scores and low downpayments.

More Minnesota home buyers are paying cash

- Article by: Jim Buchta

- Star Tribune

- May 8, 2014 – 9:58 PM

More Minnesotans are paying cash for homes despite a significant decline in sales to investors.

One-third of all sales across the state during the first three months of this year were cash deals, according to a Realtors confidence index report from the National Association of Realtors. That’s comparable to the national average, but a significant increase from two years ago when such deals represented just 19 percent of sales in Minnesota.

“I’m surprised,” said Chris Galler, CEO of the Minnesota Association of Realtors. “What agents are telling is just the opposite, they’re saying those cash deals are not as prevalent as they were.” Continue reading “One-third of real estate sales in MN are cash buyers!”

Posted in Buyers, First Time Home Buyers, Market Stats